Sugar-Sweetened Beverage Tax (Literature Review) - Other.

A persuasive essay: sugar tax. It is imperative that health policy makers implement a sugar tax in order to reduce sugar consumption among Australian consumers. A sugar tax will deter consumers from buying an excessive amount of sugary drinks.

Purpose: The purpose of this study is to investigate the impact on buying behaviour of Irish consumers since the introduction of a sugar tax on sugar sweetened soft drinks. It will seek understand if behaviour has shifted since the introduction of the tax and will identify the main factors that impact upon buying behaviour. In addition, the research will focus on both the price and sugar.

Sugar tax dissertation. Examples of structured essay questions? Research paper on role of ethicsDefine coherence in an essay how to write topics for essays. quelle police pour dissertation. Touch screen essay close essay. Ap world comparative essay, school rules argumentative essay.

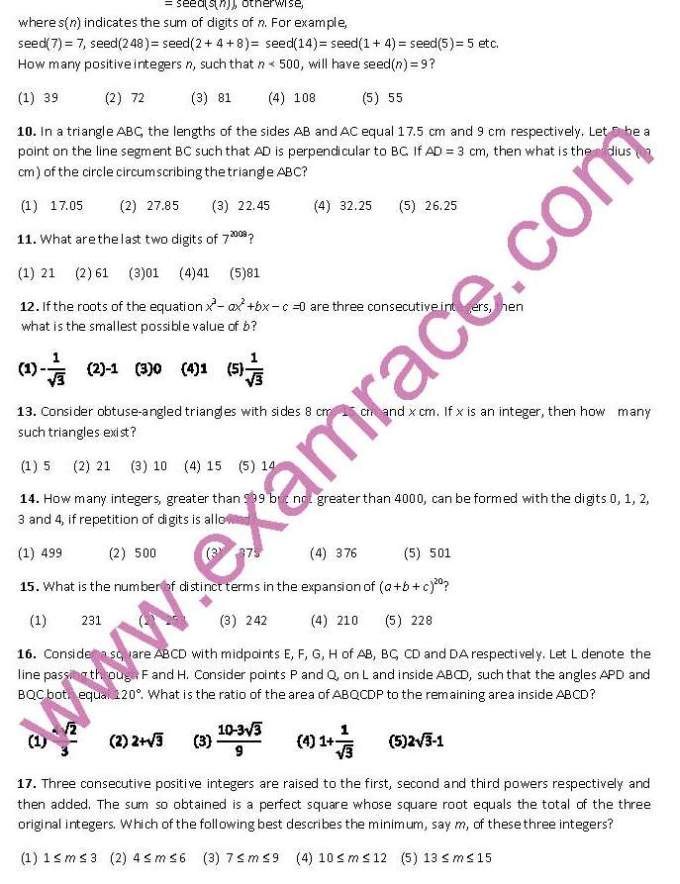

The total costs of obesity to the Australian economy are 37.7 billion dollars. The direct costs are 1.3billion dollars. The indirect costs are 6.4 billions dollars. And the disease costs are 30 billion dollars, which is a big proportion in the total costs (Medibank Health Solutions).

Donnelly L. Sugar tax in Mexico cuts sales of sugary drinks by 12 percent. The Telegraph. 2016 January 6. 30. Maniadakis N, Kapaki V, Damianidi L, Kourlaba G. A systematic review of the effectiveness of taxes on nonalcoholic beverages and high-in-fat foods as a means to prevent obesity trends.

Taxation topics based on the Effect of Tax Evasion on Government Revenue. Get these essays for writing your dissertation on Taxation assignments. Free help from Students Assignment Help is given to the students for their dissertation through these essays. How the budget of government gets imbalanced due to tax evasion of people.

Coffee House. Coffee House. Will Quince. 10 reasons why the sugar tax is a terrible idea. 25 March 2016, 12:00am.. Sugar Tax advocates point to the effect of a sugar tax in Mexico. But research.

Should Government Tax Sugary Drinks? Over the past few years, overweight and obesity have been the most troublesome problem in the united states and more than one-third of U.S. adults (around 35.7%) are obese according to Centers for Disease Control (CDC) which could lead to heart disease, stroke, diabetes and some type of cancer.

A new set of standards for UK tax policy will affect to raising the tax base rather than damaging raises in tax rates, income from dissimilar sources should be taxed in an similar method and tax should be connected to the individual, the tax system and tax policy method should be available from political whim and regular with principle and.

The Effects of a Sugar-Sweetened Beverage Tax: Consumption, Calorie Intake, Obesity, and Tax Burden by Income Abstract Taxing sugar-sweetened beverages has been proposed as a means to reduce calorie intake, improve diet and health, and generate revenue that governments can use to address the obesity-caused health and economic burden.

The trend of taxation on sugar-sweetened beverages (SSBs) has grown substantially in the past few years. This research is designed to examine different questions to different aspects of the SSB tax to get a better understanding of the effectiveness of the tax. Since the SSB tax is a sin tax, it is necessary to research some of.

The sugar tax has focused the minds of manufacturers who have been racing to market with reformulated products which will avoid the tax. Photograph: Getty Images. This week a tax on sugar.

Sugar-Sweetened Beverage (SSB) tax has stirred considerable debate both locally and internationally in the recent years and this dissertation explores some of these issues. The tax was announced in South Africa by former.