Subprime mortgage market crisis - Free Economics Essay.

Subprime mortgage crisis has caused the economies of the US and UK to slowdown and enter recession by the beginning of 2009. This study investigates the causes and effects of the subprime mortgage crisis and explores securitisation operations and their role in the economic catastrophe. Economic boom in the 2000’s created a housing bubble and.

The losses of this financial crisis are not quite clear because it was hard to estimate the losses of subprime mortgages in a declining housing market which the subprime mortgages market never experienced. What also makes it difficult is that some of these mortgages have been repackaged into complex obligations. (Calomiris, 2008). This.

The Subprime Mortgage crisis ECO 2072 Principles of Macroeconomics In the beginning One of the first indications of the late 2000 financial crisis that led to downward spiral known as the “Recession” was the subprime mortgages; known as the “mortgage mess”.

The subprime mortgage crisis, commonly referred to as the “mortgage meltdown,” unveiled itself after a sharp increase in home foreclosures beginning in 2006, which unfolded seemingly out of control by 2007. American spending declined, the housing market plunged, foreclosures continued to climb and the stock market was shaken. The subprime.

Since subprime borrowers mostly have poor credit history or low incomes, there is a greater possibility that the debts won’t be paid. Thus, making subprime mortgages risky for lenders. Therefore, to compensate the added risk, banks and other lenders charge higher interest rates on subprime mortgages. This made subprime lending very lucrative.

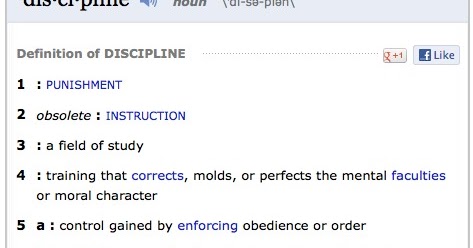

What is a subprime loan? Subprime loans are unconventional loans designed to put as many people as possible in a home or to refinance an existing home regardless of the borrowers’ credit history. A subprime loan allows lenders to make loans whether or not the borrower has poor credit, no credit or even a very low Fair Isaac Corporation (FICO.

Subprime Mortgages essaysSubprime mortgages are by definition the pervasive practice of making loans at higher interest rates and more aggressive payback terms to those with lower credit, typically to borrowers with credit scores significantly below 620 on the FICO score scale. Subprime mortgages a.

Subprime Mortgages and the Financial Crisis In the beginning of 2007 the financial crisis of the United States began to negatively alter the stability of the financial world and consequently caused the economy to spiral into the great recession.

Understanding the Subprime Mortgage Crisis. this end we use a loan-level database containing information on about half of all U.S. subprime mortgages originated between 2001 and 2007. The relatively poor performance of vintages 2006 and 2007 loans is illustrated in Figure 1 (left panel). At every mortgage loan age, loans originated in 2006 and 2007 show a much higher delinquency rate than.

A Brief Analysis of Subprime Crisis Introduction The US subprime mortgage crisis was one of the first indicators of the late-2000s financial crisis, characterized by a rise in subprime mortgage holes and foreclosures, and the resulting decline of securities backing mortgages.Approximately 80% of U.S.

Sub-prime mortgages are generally for borrowers with a low credit score. They often have higher interest rates, prepayment penalties, balloon payments, and run a greater risk of foreclosure. Many times, subprime mortgages are adjustable rate mortgages. These start out with a low rate for the first year or two and then adjust every 6 months or.

In finance, subprime lending (also referred to as near-prime, subpar, non-prime, and second-chance lending) is the provision of loans to people who may have difficulty maintaining the repayment schedule. Historically, subprime borrowers were defined as having FICO scores below 600, although this threshold has varied over time.

The packaging of sub-prime mortgages and credit card debts into bonds, (i.e. asset backed securities) were then traded on the global capital markets. Investors acquired these bonds, to a certain extent on the basis of the creditworthiness of the securitiser as well as on an evaluation of the reliability of the income flows of the underlying assets (credits cards, mortgages etc). However, part.